Established in 2012, SPD Silicon Valley Bank (SSVB) is a groundbreaking joint venture between Silicon Valley Bank (SVB) and Shanghai Pudong Development Bank (SPDB). As China's first bank dedicated to the innovation economy, SSVB has inherited, localized and iterated SVB's business model attuned to China's distinctive market for the past decade. Today, SSVB stands as a recognized brand in China's innovation ecosystem, offering unrivaled reach to hundreds of the nation's top-tier VC and PE firms and thousands of innovation companies. Additionally, SSVB's strategic position also offers global investors, partners and innovation companies a unique gateway to access China's innovation ecosystem.

Headquartered in Shanghai, SSVB operates on a national scale under a national banking license, providing services through its offices and branches spanning Shanghai, Beijing, Shenzhen and Suzhou. As of December 2023, SSVB has served cumulative total of over 5000 fast-growing companies, as well as nearly 300 VC and PE firms in China.

Pioneering

China's innovation economy

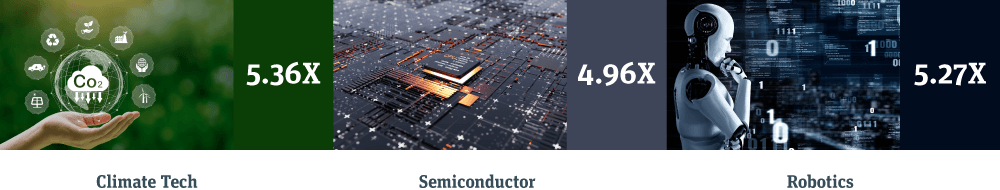

In recent years, SSVB has grasped the major market opportunities in China by tapping into profound network across five pivotal industry sectors: Digital Transformation, Advanced Manufacturing, Semiconductor, Life Science & Healthcare and Climate Tech & New Energy. SSVB has successfully engaged and supported thousands of dynamic and fast-growing innovation companies across 80+ niches within the above sectors and nurtured large number of leading players in many sub-sectors.

Transformation

Cloud computing |

AI+IoT+5G

Manufacturing

EV & Automation Drive

Foundry, Assembly & Test

Healthcare

Device

New Energy

Clean energy

The average valuation step-ups1 of SSVB’s clients in major sectors since they were first financed by SSVB:

1The step-ups are calculated by dividing the company's valuation as of January 2023 by its initial valuation when it was frst fnanced by SSVB.

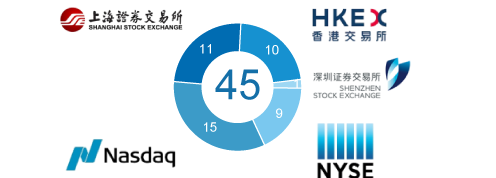

Notably, 45 of our clients have successfully listed on stock exchanges in the United States and China (Mainland China and China Hong Kong SAR).2

2As of December 2023. 0ne client lists on both HKSE & SZSE.

Notably, 45 of our clients have successfully listed on stock exchanges in the United States and China (Mainland China and China Hong Kong SAR).2

2As of December 2023. 0ne client lists on both HKSE & SZSE.

Empowered by SSVB's financing support, the innovation companies we served have experienced substantial growth and successfully secured significant amount of equity financing of

3As of December 2023.

2023 Q3 CAR Disclosure

2023 Q3 CAR Disclosure